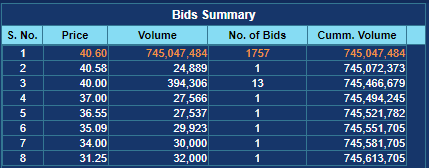

The book-building process of Octopus Digital’s Initial Public Offer (IPO) has concluded with an oversubscription of 27 times. The Octopus Digital has received an overwhelming response from institutional investors and high-net worth individuals as the strike price clocked in at Rs 40.6/share, 40% higher than the floor price of Rs29.

The company received the offer of 745,613,704 shares against the total issue size of 27.35Mn with the strike price of 40.6.

By close on the first day, Octopus Digital received offers of 211,080,012 shares, with the strike price having already reached its upper limit of PKR 40.6

The target quantity was met in the first 24 minutes after the opening of the bidding session. The total bid size against issue size of 27.35 million shares crossed 7.7x on day one.The Retail Portion of the Issue is scheduled on September 16 & 17, 2021.

Octopus Digital is a 100 percent wholly owned subsidiary of Avanceon Limited, and focuses on digitalization solutions for various businesses, apart from providing tech upgradation, and database maintenance services.